Power Your Software Testing with AI and Cloud

Supercharge QA with AI for Faster & Smarter Software Testing

- Testing Basics

- Home

- /

- Learning Hub

- /

- 90+ Insurance Statistics, Data & Industry Trends

90+ Insurance Statistics, Data & Industry Trends

Discover the power of insurance statistics and how they can help you make smarter decisions. Turn insurance statistics into actionable insights with our guide.

Last Modified on: September 26, 2025

Total Chapters (2)

Chapter 1 : Insurance Statistics

- Share:

OVERVIEW

In today's society, insurance is essential because it protects both individuals and businesses financially from unforeseen occurrences and losses. The insurance market has changed significantly over the years, and it now includes a diverse range of goods and services, all of which are catered to the particular requirements of policyholders. Statistics are an essential tool for comprehending the insurance market, from monitoring the expansion of particular product categories to spotting new risks and trends.

By understanding insurance statistics you can gain deeper insights into the insurance industry as a whole. These insights are helpful in providing useful information whether you're an insurance professional or just someone who wants to learn more about this intricate and fascinating industry.

Global Insurance Statistics

- Asia-Pacific is projected to represent 42% of worldwide premiums by 2029, with China's share anticipated to reach 20%. Furthermore, China is expected to emerge as the largest insurance market by the mid-2030s. (Swiss Re Institute)

- the total capital allocated to the global reinsurance sector was $638 billion by the conclusion of 2022, which signifies a decline of 12% from the restated capital of $725 billion at the end of 2021. (Arthur J. Gallagher & Co.)

- The global cyber insurance market is projected to reach $20.4 billion by 2025. (MarketsandMarkets)

- The global insurance industry is projected to grow by 3.9% annually between 2020 and 2025. (Statista)

- In 2020, the global insurance industry paid out $1.7 trillion in claims. (Swiss Re Institute)

- The global cyber insurance market is expected to grow at a compound annual growth rate of 25% from 2021 to 2028. (Fortune Business Insights)

Global Insurance Statistics Projections by Grand View Research

| Global Insurance Market Type | Projected to Reach by 2027 |

|---|---|

| Marine insurance market | $68.3 billion |

| Property and casualty insurance market | $1.2 trillion |

| Travel insurance market | $35.1 billion |

| Liability insurance market | $1.7 trillion |

| Agriculture insurance market | $37.8 billion |

| Crop insurance market | $6.3 billion |

| Drone insurance market | $8.7 billion |

| Event insurance market | $24.3 billion |

| Aviation insurance market | $25.1 billion |

| Space insurance market | $1.9 billion |

| Natural catastrophe insurance market | $115.7 billion |

| Car insurance market | $901 billion |

| Surety bond insurance market | $23.4 billion |

| Gig economy insurance market | $10.5 billion |

| Yacht insurance market | $4.4 billion |

| Product liability insurance market | $18.7 billion |

| Space launch insurance market | $513.8 million |

| Equine insurance market | $1.7 billion |

| Trade finance insurance market | $4.3 billion |

| Art insurance market | $2.8 billion |

| Livestock insurance market | $7.6 billion |

| Terrorism insurance market | $12.3 billion |

| Kidnap and ransom insurance market | $13.9 billion |

| Cyber liability insurance market | $19.7 billion |

| Satellite insurance market | $1.4 billion |

| Title insurance market | $8.4 billion |

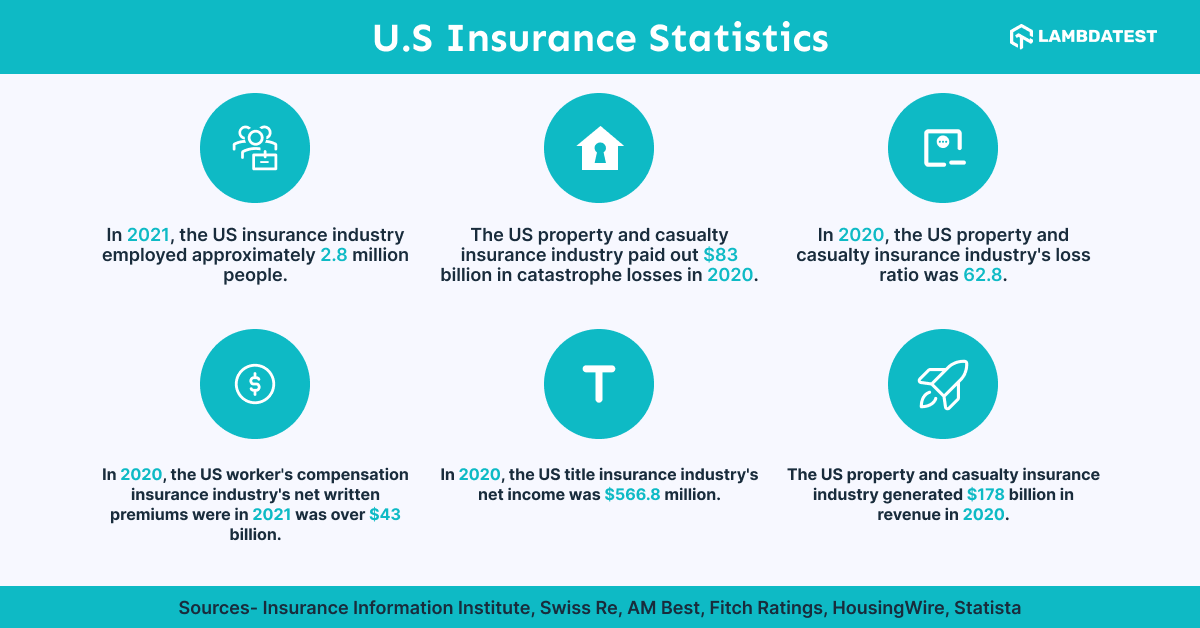

US Insurance Statistics

- The US property and casualty insurance industry paid out $83 billion in catastrophe losses in 2020. (Swiss Re)

- In 2020, the US property and casualty insurance industry's loss ratio was 62.8. (AM Best)

- In 2020, the US worker's compensation insurance industry's net written premiums were in 2021 was over $43 billion. (Fitch Ratings)

- In 2020, the US title insurance industry's net income was $566.8 million. (HousingWire)

- The US property and casualty insurance industry generated $178 billion in revenue in 2020. (Statista)

- In 2020, the US property and casualty insurance industry's combined ratio was 98.2. (Insurance Information Institute)

- The US unemployment rate for workers in the insurance industry was 2.0% in February 2021. (US Bureau of Labor Statistics)

- In 2021, the US property and casualty insurance industry's net income was $39.8 billion. (Insurance Information Institute)

- In 2021, the US property and casualty insurance industry's capital & surplus was $1,077.6 billion. (Insurance Information Institute)

- In 2023, the US commercial auto insurance market size was 53.1 billion. (National Association of Insurance Commissioners)

- The projected value of the US Commercial Insurance Market is anticipated to be USD 136.6 billion in 2022, with a projected growth of USD 221 billion by 2027, at a compound annual growth rate (CAGR) of 10.1%. (Research & Markets.com)

- The US surety bond insurance industry's was valued at $16.07 billion and is projected to reach $25.18 billion by 2027. (The Insight Partners)

- In 2020, the US medical malpractice insurance industry's net income was $1.1 billion. (National Association of Insurance Commissioners)

- In 2021, the US cyber insurance industry's revenue totaled at was $9.5 billion. (Future Market Insights)

- In 2021, the US reinsurance industry's is valued at $498.7 billion. (Allied Market Research)

- As per data from NAIC compiled by S&P Global Market Intelligence, the net premiums written for private flood insurance amounted to $302.4 million in 2020, showing a 5.3% increase from $287.2 million in 2019.

- In 2019, the average auto insurance expenditure across US increased by 1.0% to reach $1,070.47 as compared to $1,059.41 in 2018. (National Association of Insurance Commissioners)

- In 2021, the US workers' compensation insurance industry's net premiums written was $42.68 million. (III)

Life Insurance Statistics

- Since 2021, there has been a 2% decline in life insurance ownership rates, and a 13% decline over the previous ten years.

- As of 2022, direct life insurance premiums generated over $160 billion.

- In 2020, the global life insurance industry's net income was $147 billion. (Swiss Re Institute)

- Life insurance ownership in the US has declined from 77% of Americans having it in 1989 to 54% in 2020. (Insurance Information Institute)

- In 2020, the US life insurance industry paid out $87.3 billion in claims. (Insurance Information Institute)

- In 2020, the US life insurance industry's net income was $38.9 billion. (Insurance Information Institute)

- The global life insurance market is projected to reach $4.5 trillion by 2027. (Grand View Research)

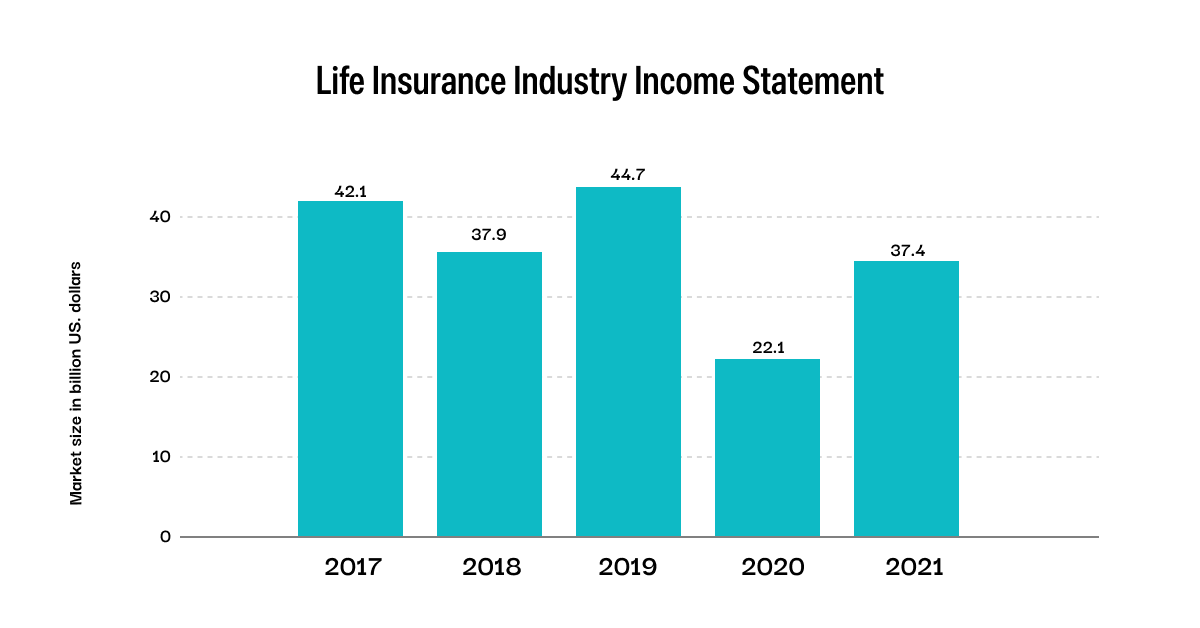

- Life Insurance Industry Income Statement recorded for year 2021 was $37.4 billion dollars. Here is a graph showing the data since year 2017.

- The expense ratio for the life insurance sector increased to 10.86% in 2021 from 10.71% in 2020 as general insurance costs increased to $68.76 billion from $67.02 billion the previous year.

- In 2020, the US life insurance industry's loss ratio was 56.2. (Insurance Information Institute)

Note: Our Unified Testing Cloud built for the insurance sector will enable quicker releases and help you craft a seamless digital experience for your customers. Leading digital experience testing for insurance sector.

Health Insurance Statistics

- 87 percent of full-time workers had access to medical insurance in 2019, according to the Bureau of Labor Statistics (BLS).

- In 2020, the US health insurance industry generated $1.2 trillion in premiums. (National Association of Insurance Commissioners)

- Revenue from health and medical insurance increased at a CAGR of 2.3% over the previous five years, reaching $1.2 trillion, with a 0.7% decline in 2023 alone. (IBIS world)

- Between 2021 and 2027, the US market for health and medical insurance is anticipated to expand at a CAGR of 7.95%. (Mordor Intelligence)

- Hospital and medical costs for the U.S. health insurance industry increased 13.5% ($92 billion) from 2020 to 2021. (National Association of Insurance Commissioners)

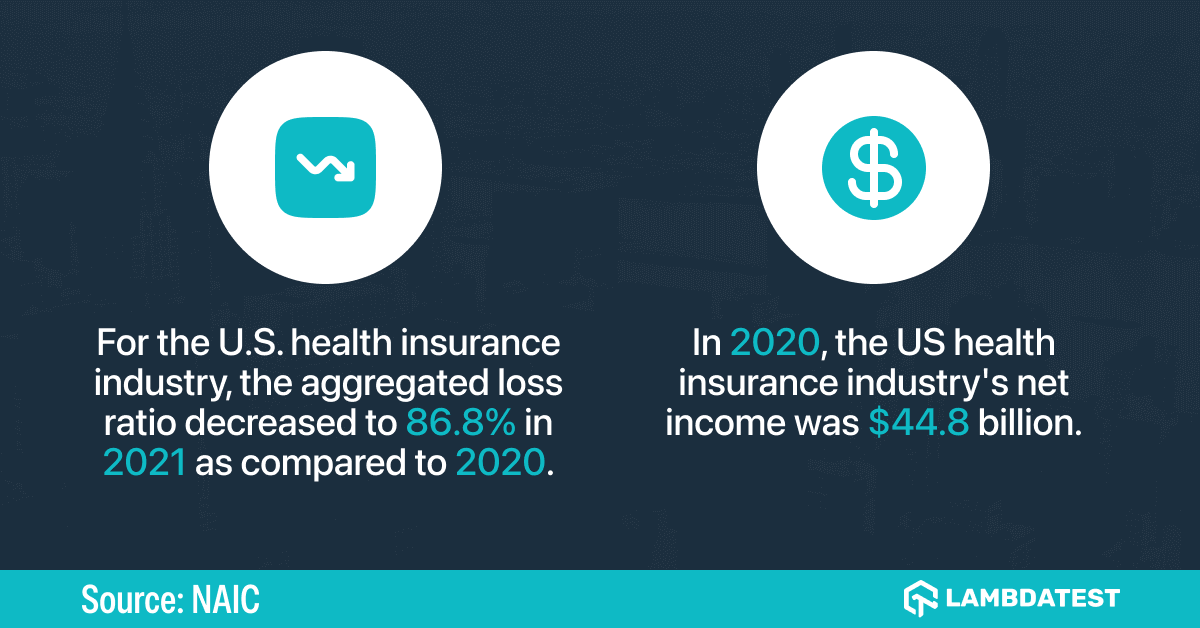

- For the U.S. health insurance industry, the aggregated loss ratio decreased to 86.8% in 2021 as compared to 2020. (National Association of Insurance Commissioners)

- In 2020, the US health insurance industry's net income was $44.8 billion. (National Association of Insurance Commissioners)

- In 2020, the US health insurance industry's loss ratio was 84.9. (National Association of Insurance Commissioners)

- The global health insurance market is projected to reach $1,865.2 billion by 2028. (Fortune Business Insights)

Insurtech Statistics

- In the first half of 2022, global insurtech companies received approximately four billion U.S. dollars in investments, which was significantly lower compared to the previous two years, with 14.8 billion U.S. dollars invested in 2021 and 16.6 billion U.S. dollars in 2020. (Statista)

- In 2021, North America accounted for over 36% of the insurtech market share. (Acumen)

- Insurtech startups have attracted a total of $16.5 billion in investments over the past decade, and the first three quarters of 2021 witnessed more investment in insurtech than the combined total of 2019 and 2020. (Deloitte)

- Global insurtech financing activity remained unchanged for two consecutive quarters at 2.4 billion U.S. dollars in the first half of 2022, after reaching a four-year high of 5.4 billion U.S. dollars in the final quarter of 2021. (Statista)

- Insurtech market of the Asia-Pacific region is expected to experience rapid growth during the forecasted period from 2022 to 2030. (Acumen)

Pet Insurance Statistics

- In 2020, the US pet insurance industry's net income was $1.9 billion. (North American Pet Health Insurance Association)

- By 2030, the pet insurance market is expected to reach $31.13 billion, growing at a 16.3% CAGR. (Beyond Market Insights)

- Pet Insurance Market Size value in 2022 is $ 9.3 billion. (Beyond Market Insights)

- Revenue Forecast for 2030 for Pet Insurance Market is $ 31.13 billion. (Beyond Market Insights)

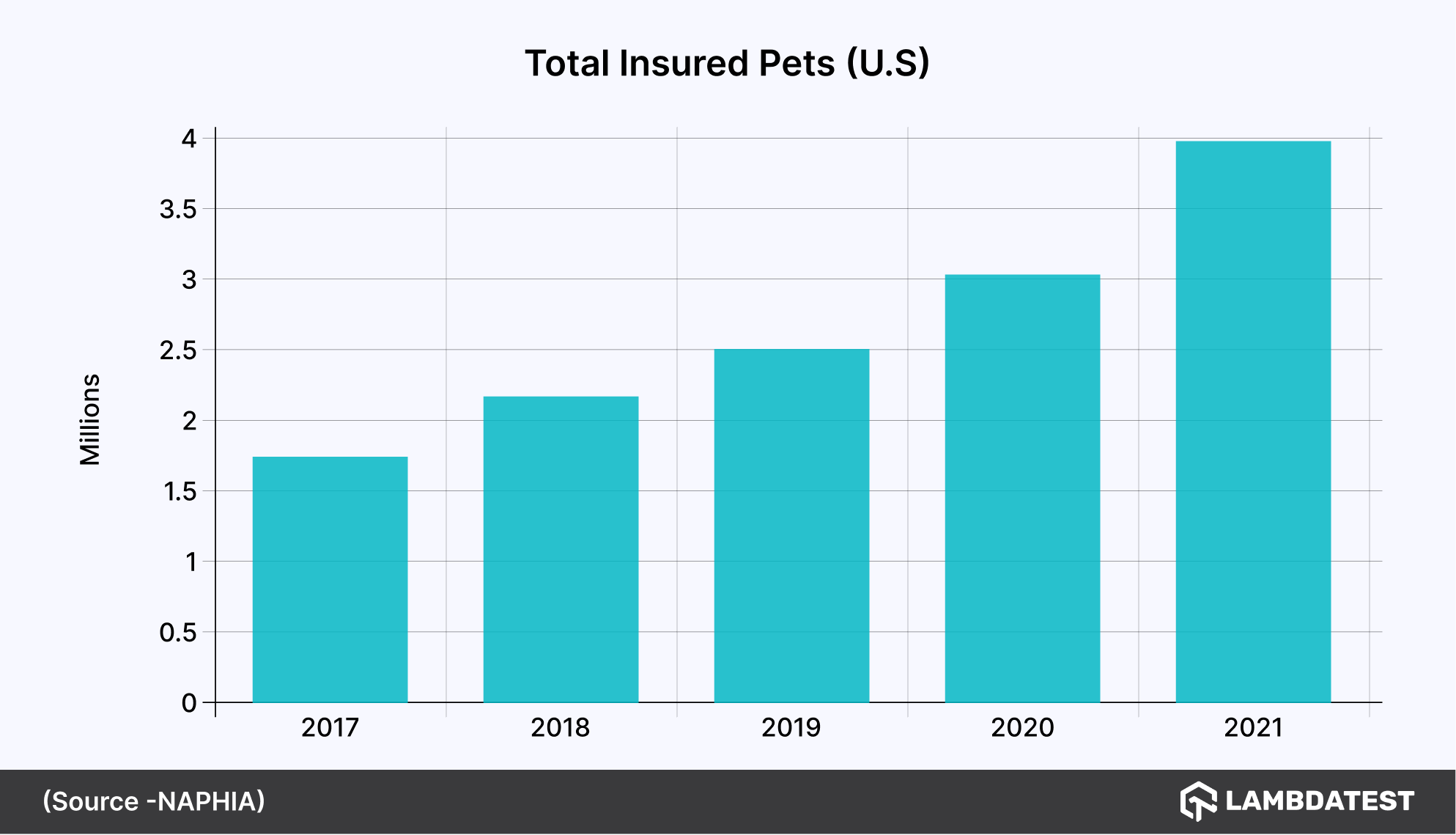

- From 2017 to 2021, the Insured Pets industry experienced an average yearly growth rate of 21.5%. (NAPHIA)

Note: Our Unified Testing Cloud built for the insurance sector will enable quicker releases and help you craft a seamless digital experience for your customers.Leading digital experience testing for insurance sector.

Automation Testing Statistics

Automation testing, the practice of using software tools to automatically execute tests, can greatly benefit insurance companies in several ways. The complicated systems and vast amounts of data that insurance companies work with make their applications prone to human error. Automation testing makes testing faster and more accurate, which lowers the chance of errors.

Secondly, automation testing helps insurance companies achieve higher test coverage. Insurance applications typically have various functionalities, workflows, and scenarios that need to be thoroughly tested. With automation testing, companies can create and execute a wide range of tests.

- Percentage of types of automation tests adopted in the year 2022 where Load & Stress testing at 31%, CI/CD at 44%, Unit testing at 45% while Functional & Regression testing at 73%. (Kobiton)

- Automation testing market share for the mobile segment with recorded revenue of USD 6 billion in 2022. (GM Insights)

- Approximately 20% of the demand for software testing is driven by the federal and state governments of the US.

- The primary hurdle faced by 26% of companies is identifying the appropriate tools for test automation, which proves to be their greatest challenge. (Kobiton)

- Test automation plays a critical role in the quality assurance process for nearly half of all companies, with 43% of organizations relying on it as a fundamental component. (DOGQ)

Categories of Insurance

These ones below are some of the most common types of insurance, but there are many other specialized types of insurance as well, such as aviation insurance, marine insurance, kidnap and ransom insurance, and more. Let's understand them.

- Life insurance: A contract between an insurance policyholder and an insurer where the insurer guarantees to pay a designated beneficiary a sum of money upon the death of the policyholder.

- Health insurance: A type of insurance coverage that pays for medical and surgical expenses incurred by the insured.

- Property insurance: Provides financial reimbursement to the owner or renter of a structure and its contents in the event of damage or theft.

- Liability insurance: Provides protection against claims resulting from injuries and damage to other people or property.

- Auto insurance: Provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

- Travel insurance: Provides protection for unexpected events that can occur while travelling, such as trip cancellation, medical emergencies, lost luggage, and more.

- Disability insurance: Provides financial benefits to a policyholder in the event that they become disabled and are unable to work.

- Pet insurance: Provides coverage for veterinary expenses in case of illness or injury to pets.

- Flood insurance: Provides coverage for damages caused by flooding, which is typically not covered under a standard homeowner's insurance policy.

- Cyber insurance: Provides coverage against losses resulting from cyber attacks, data breaches, and other technology-related risks.

References

- Life Insurance - Insurance Information Institute (III)

- Insurance Barometer - LIMRA. (April, 2022)

- Insurance market share data - National Association of Insurance Commissioners(2021)

- Economy & insurance - Swiss Re Institute

- Insurance expense ratio - S&P Global Market Intelligence

- Labour insurance - Bureau of Labor Statistics (BLS)

- Health & medical insurance - Mordor Intelligence

- Pet insurance - Beyond Market insights

- Insured Pets - North American Pet Health Insurance Association

- US workers insurance - Fitch Ratings

- Property casualty insurance - Statista

- Insurance report - NAIC

- Insurtech - NAIC

- Cybersecurity insurance - Future Market Insights

- Health insurance industry - National Association of Insurance Commissioners

Frequently asked questions

- General

Did you find this page helpful?

More Related Hubs

Start your journey with LambdaTest

Get 100 minutes of automation test minutes FREE!!