KaneAI - GenAI Testing Agent

Plan, author and evolve end to end automation test using natural language prompts.

Sample Test Cases for Insurance Domain Testing

- Learning Hub

- Sample Test Cases for Insurance Domain Testing

CHAPTERS

- Overview

- Writing Effective Test Cases

- Snowflake Test Case Template

- CI CD Test Case Template

- Jenkins Test Case Template

- Salesforce Test Case Template

- ServiceNow Test Case Template

- Shopify Test Case Template

- Signup Page Test Case Template

- Ecommerce Test Case Template

- Xamarin Test Case Template

- React Test Case Template

- Angular Test Case Template

- Gaming Platform Test Case Template

- Vercel Test Case Template

- Wix Test Case Template

- CMS Test Case Template

- Flutter Test Case Template

- Site Generator Test Case Template

- Website Builder Test Case Template

- Mobile Development Test Case Template

- Healthcare Domain Test Case Template

- Insurance Domain Test Case Template

- Retail Testing Test Case Template

- Media and Entertainment App Testing Test Case Template

- Telecom Domain Test Case Template

- Travel and Hospitality App Testing Test Case Template

- Test Case Templates For Banking Application Testinge

- Test Cases For The Login And Registration Page

OVERVIEW

Insurance is an essential part of modern life. It serves an important role in protecting individuals, businesses, and society as a whole, from health and life insurance to property and liability insurance. Because of digitalization, insurance companies adapt many digital components to make it reachable to a maximum number of clients.

However, ensuring that insurance policies are handled and managed correctly can be a difficult undertaking. This is where insurance domain testing may help. It entails testing software used in activities like policy management, claim processing, and enrollment. With complicated rules, numerous operations, and diverse stakeholders, the insurance domain is unique in its complexity.

As a tester performing insurance application testing, you must have basic knowledge of how the insurance domain works. In this section, you'll learn about the insurance domain and its operations. Additionally, we have included all major and miscellaneous test case templates, which every tester should use to verify during insurance domain testing.

Download test case templates for insurance domain testing now!

Download the Insurance domain testing test case template to efficiently evaluate and ensure the quality of your insurance domain websites.

SEE MORE →- Overview of Insurance domain applications

- How does insurance works?

- Enrollment Procedures for Insurance Policies

- Importance of insurance domain testing

- Test cases for insurance domain website testing

- Perform insurance domain testing with LambdaTest

- Wrapping it up!

- Frequently Asked Questions (FAQs)

Overview of Insurance domain applications

The insurance domain is a sector of the industry that provides protection against the risk of loss, damages, and death in exchange for a premium. The insurance domain is separated into many sectors, such as life insurance, Automobile insurance, property insurance, and health insurance. Also, it includes some complex functionalities such as policy administration, premium collection, Claims and underwriting, etc.

In recent years Insurance domain has adopted many technological advancements that transformed the way insurance companies run. All insurance businesses maintain their IT infrastructure and take into account that they have also invested in guaranteeing whether or not their application functions correctly in real-time.

How does insurance works?

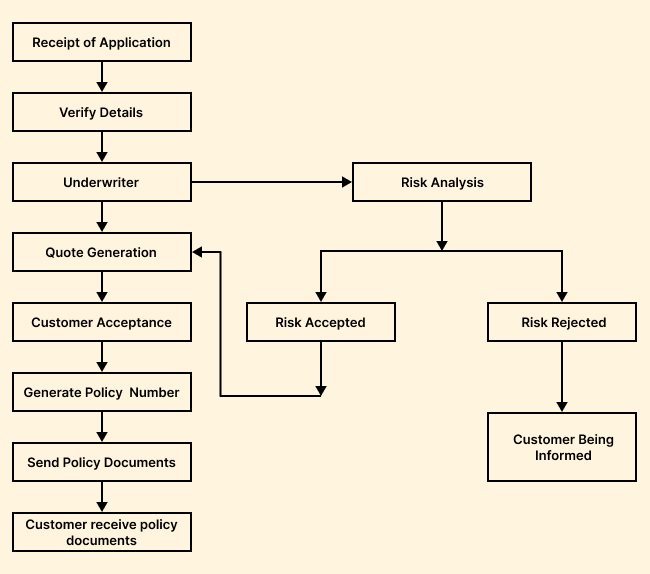

Insurance is a type of risk management that protects individuals and businesses financially against the danger of loss or damage. In exchange for the payment of a premium, insurance companies offer policies that transfer the risk of future losses from individuals or organizations to the insurer. Here is the flow of how insurance works:

- When a person or organization buys insurance, they enter into a contract with the insurer. The contract outlines the policy's terms, such as the type of coverage offered, the premium amount, the conditions under which a claim may be filed, and any exclusions or limitations.

- The cost of the policyholder's premium is determined by several criteria, including the level of risk involved with the policy, the chance of a claim being filed, and the quantity of coverage offered. To establish the proper level of risk and calculate the premium amount, insurance firms employ actuarial data and statistical research.

- If the policyholder suffers a loss or damage that the policy covers, they can make a claim with the insurer. The insurer will evaluate the claim and, if it is found to be valid, will pay the policyholder a set sum to reimburse the losses or damages sustained. The amount paid out by the insurer is usually subject to the policy's deductibles and limits.

That is how individuals or organizations transfer the risk to the insurance companies and get financial protection over the possible damages and losses.

Enrollment Procedures for Insurance Policies

The graphic below illustrates the high-level process flow for policy enrollment and how it is handled by various insurance applications.

Importance of insurance domain testing

Insurance domain websites is highly connected with emergencies related to finance and health. They have several software and websites to fulfill end users' needs. There are occasions when the same insurance product moves swiftly in one area of the country but slowly in another section of the country. Because of such customer variation, those insurance bases made modifications as per their local customers and organizations. And that's why all of those modifications work properly; Insurance application testing is important.

Some benefits of insurance domain testing are:

- Ensures Compliance: Insurance businesses are subject to regulatory restrictions that necessitate the use of specific software and the collection and analysis of specific data. Insurance domain Testing ensures that the program is compliant with these rules.

- Prevent financial losses: Insurance firms handle sensitive financial information such as policy details, premiums, and claims data, which helps to prevent financial loss. Insurance application testing assists in identifying and correcting vulnerabilities that can result in financial losses or other obligations.

- Reduces Business Risks: Insurance domain testing aids in the identification and mitigation of risks connected with software failure, ensuring that the insurance firm can continue to function uninterrupted.

- Time saving: Insurance application testing saves time and resources by detecting faults early in the development process, lowering the cost of correcting defects later in the development cycle. It also saves time by automating repetitive testing procedures and freeing up developers' time to focus on more important concerns.

Download test case templates for insurance domain testing now!

Download the Insurance domain testing test case template to efficiently evaluate and ensure the quality of your insurance domain websites.

SEE MORE →Test cases for insurance domain website testing

User Management-Related Test Cases

User management is an important component of insurance domain testing because it comprises evaluating the features related to user registration, login, password management, and profile update. Following are some areas testers should test for user management:

- User Registration: The user registration process should be evaluated to confirm that users may register with legitimate information, such as a unique email ID, name, address, and phone number. The test cases should also ensure the registration confirmation email is delivered to the registered email address.

- Login and Logout features: Login and logout features should be tested to guarantee that users can log in and out of the website using valid login credentials. The test cases should ensure that following a successful login, the user is forwarded to the homepage and that the user's session is terminated after logging out.

- Password Management: Password management features should be verified to verify that users may change and recover their passwords if they forget them. The test cases should also ensure that credentials are safely saved and not visible to unauthorized users.

- Profile Update: The profile update capability should be validated to confirm that the user's profile information, such as their name, address, and contact number, can be updated. The test cases should also ensure that the user's information is safely maintained and is not accessible to unauthorized individuals

- Account Deletion: The account deletion feature should be verified to guarantee that users can delete their accounts if they no longer require them. The test cases should additionally ensure that the user's data is completely removed from the system.

Policy Management-related test cases

Another key component of insurance domain testing is policy management, which entails testing the capabilities related to policy formation, modification, and cancellation. Here are the following test cases for testing the website’s policy management.

- Policy Creation: The policy creation process should be checked to ensure that valid details, such as policy type, coverage, riders, and premiums, are included. The test cases should also ensure that the policies are properly written and kept in the database.

- Policy Modification: The policy modification capability should be evaluated to ensure that user-made policy modifications are properly reflected. The test cases should ensure that any policy changes, such as adding or deleting riders, changing the coverage level, or amending the premium amount, are properly recorded.

- Policy Deletion: The feature for deleting policies should be evaluated to guarantee that the policy can be deleted if the user no longer needs it. The test cases should additionally ensure that the policy data is permanently removed from the system.

- Premium Calculation: The premium calculation capability should be evaluated to ensure that the premium amount is computed correctly depending on the information provided by the user, such as age, occupation, and health condition. The test cases should also ensure that the premiums are calculated correctly and securely kept in the database.

- Discounts and Promotions: The discounts and promotions functionality should be tested to ensure that consumers can take advantage of the website's discounts and promotions. The test cases should ensure that the discounts are implemented correctly and that users are informed of the available promotions.

Claim Management related test cases

Claim Management is an important component of insurance domain testing because it evaluates the capabilities associated with claim submission, processing, and payment. Here are the test cases required to test claim management of insurance application testing.

- Claim Submission: The claim submission process should be tested to ensure that users can submit claims with accurate details such as claim type, incident date, description, and supporting documents. The test cases should ensure that claims are filed and securely saved in the database.

- Claim Processing: To guarantee that claims are processed efficiently and accurately, the claim processing capability should be tested. The test cases should ensure that claims are assigned to the correct department or individual for evaluation and that the claim status is updated on a timely basis.

- Claim Settlement: To guarantee that claims are handled quickly and accurately, the claim settlement capability should be checked. The test cases should ensure that claims are settled within the time limit agreed upon and that the settlement amount is calculated accurately based on the policy coverage.

- Claim Tracking: The claim tracking capability should be verified to verify that users can always track the status of their claims. The test cases should ensure that users can see the current status of their claims, any modifications, and the expected time to resolve the claim.

- Fraud Detection: To guarantee that the website can detect and prevent fraudulent claims, the fraud detection feature should be evaluated. The test cases should demonstrate that the website can identify dubious claims for evaluation, such as those with conflicting details or numerous claims for the same incident.

Payment process-related test cases

Payment process testing in the insurance domain testing includes testing payment gateway integration and payment processing functionalities. Here are some test cases to keep in mind while doing Payment process testing:

- Payment Gateway Integration: This should be tested to ensure that the website can safely integrate with the payment gateway provider. The test cases should ensure that the website can communicate with the payment gateway provider and that the payment gateway provider can safely accept and process payment information.

- Payment Processing: To verify that payment transactions are performed correctly, the payment processing capability should be tested. The test cases should ensure that payment parameters such as payment amount, payment method, and payment date are accurately handled and that the payment status is updated on time.

- Cancellations and refunds: The refunds and cancellations functionality should be tested to ensure that users can seek refunds or cancel payments as needed. The test cases should ensure that the refund or cancellation request is correctly processed and that the payment details are correctly updated in the system.

- Secure Payment Processing: To guarantee that payment processing is secure and satisfies industry standards, secure payment processing capabilities should be tested. The test cases should ensure that payment transactions are encrypted and payment information is securely maintained in the database.

- Payment Confirmation: After finishing the payment process, the payment confirmation functionality should be checked to ensure that users receive a payment confirmation. The test cases should ensure that the payment confirmation contains payment details such as the payment amount, payment method, and payment date.

Document management-related test cases

Document management is an important component of insurance domain testing because it entails testing the functionality of document upload, processing, and retrieval. Some of the test cases for document management are as below:

- Document Upload: The document upload capability should be tested to ensure that users can easily and accurately upload their papers. The test cases should ensure that users may upload documents in the proper format, such as PDF, JPG, or PNG, and that the documents are securely saved in the database.

- Document Processing: The document processing capability should be tested to confirm that the uploaded documents are correctly processed by the website. The test cases should demonstrate that the website can handle documents, such as extracting text, photos, or other relevant information and storing it in a database.

- Document Retrieval: The document retrieval capability should be evaluated to guarantee that users can easily and accurately retrieve their documents. The test cases should ensure that users can retrieve documents by searching for them using relevant keywords or document kinds and that the papers retrieved are correct and up to date.

- Document Storage and Retrieval: The capability for document storage and retrieval should be evaluated to guarantee that the website can safely store and retrieve documents. The test cases should ensure that the documents are stored in a safe database or file system, and that access to them is controlled based on the user's role and authorization.

- Document Verification: The website's document verification capability should be checked to guarantee that the authenticity and validity of the uploaded documents can be verified. The test cases should demonstrate that the website can validate the document's metadata, such as the author, creation date, or change date, and that the document's content satisfies the policy terms and conditions.

Customer support-related test cases

Customer support in insurance domain testing involves testing customer support functionalities such as chat support, email assistance, and phone support. Here are some major test cases for testing customer support.

- Contact Us Form: The contact us form in the Insurance application testing functionality should be tested to verify that users can quickly and accurately contact the customer care team.

- Chat Support: Chat support in insurance application testing should be tested to ensure that users can quickly and accurately contact the customer support team via chat support. The test cases should ensure that users may start a chat session with the support team and that the support team responds in a timely and effective manner.

- Email Support: The email support capability in insurance application testing should be tested to ensure that users may simply and accurately contact the customer support team via email support. The test cases should demonstrate that users may send an email to the support team with the appropriate information, such as the policy number or claim number, and that the support team can react quickly and effectively.

- Phone Support: The phone support capability should be tested to ensure that users can quickly and accurately contact the customer support team via phone support. The test cases should ensure that users may contact the support team and speak with a support person in a timely manner and that the representative can provide effective solutions to the user's questions or difficulties.

- Support Response Time: The support response time feature should be checked to ensure that the support team can respond to users' queries or issues in a timely and effective manner. The test cases should ensure that the support team can reply to the user's questions or difficulties in an acceptable amount of time, such as 24 hours, and provide appropriate answers.

Reports and analytics related test cases

Report and analytics testing test cases involve users who can generate correct and relevant reports, and the website can analyze data accurately and securely; it makes testing reports and analytics important in insurance domain testing. Some of the test scenarios that can be run as part of Reports and Analytics testing are as follows:

- Report Generation: The report generation in insurance application testing functionality should be validated to verify that users can generate accurate and relevant reports.

- Data Analysis: The data analysis capability should be checked to guarantee that the website can accurately and safely analyze the data.

- Report Export: The report export functionality should be validated to ensure that users may export created reports in different formats such as PDF, Excel, or CSV.

- Report Customization: Test the report customization capabilities to ensure that customers can customize the generated reports according to their needs.

- Report Access Control: Test the report access control capability to confirm that access to generated reports is restricted based on user role and authorization.

Quota management-related test cases

Quote-related test cases are critical for insurance domain testing since they test the functionality of delivering quotes to consumers for various insurance policies. Some of the test cases that can be run as part of Quotations testing are as follows:

- Policy Selection: The functionality of policy selection should be evaluated to ensure that users may select the appropriate policy type, such as vehicle insurance, health insurance, or life insurance.

- Quote Calculation: The quote calculation mechanism during insurance application testing should be checked to ensure that the website can generate correct and appropriate quotes for the chosen insurance policy.

- Quote Comparison: Test the quote comparison functionality to ensure that users may compare quotations for different insurance.

- Quote Sharing: The quote-sharing functionality while insurance application testing should be tested to ensure that users may share quotes with others, such as relatives and friends.

- Quote Purchase: The quote purchase functionality should be tested to guarantee that users may buy the chosen policy after receiving the quote.

Miscellaneous test cases

After understanding some crucial and domain-specific test cases for insurance domain testing you also should test the website’s performance, compatibility, security, and all. Here are some important test cases you can include while insurance domain testing.

- Integration with third-party services: Experiment with the website's integration with third-party services such as payment gateways and social networking platforms.

- Security: in the insurance domain testing security testing means examining the website's security features, such as HTTPS protocol, firewalls, and encryption protocols, and confirming that it adheres to the essential security requirements to secure user data.

- Multi-language support: Check sure the website supports several languages and that the translated material is accurate and well-formatted.

- Accessibility: Check the website's accessibility for persons with disabilities, such as those who are blind or have restricted mobility, and make sure it fulfills accessibility rules.

- User experience: Examine the website from the perspective of a typical user to ensure that it is easy to navigate, has clear instructions and is visually appealing.

- Performance testing: performance testing involves testing the website's performance under various conditions, such as high traffic or slow internet bandwidth, to ensure that it responds fast and without mistakes.

- API testing: During insurance application testing, Check that the APIs used by the website are working properly and returning the anticipated results.

- Integration testing: Testing the integration of several website components, such as the policy buying process, claims to process, and policy management, to ensure that they work together effortlessly.

- Load testing: Check the website's ability to accommodate a large number of concurrent users and guarantee that it stays stable and responsive even while under severe load.

- Usability testing: Usability testing should be performed to discover any usability flaws, such as confused navigation, imprecise instructions, or broken links.

- Testing for cross-site scripting (XSS) vulnerabilities: Examine the website for vulnerabilities to cross-site scripting attacks, which allow malicious users to steal user data or change website content.

- Data validation: During insurance application testing, evaluate the website's capacity to handle various forms of data, such as alphanumeric letters, special characters, and numbers, and ensure that data entered by users is properly validated.

- User role testing: Verify that each user role, such as user, admin, or agent, has the required access and permissions.

- Compilation testing: In insurance application testing, compliance testing ensures that the website conforms with industry standards such as HIPAA, GDPR, or PCI-DSS, as well as that it adheres to the appropriate guidelines to protect user data and privacy.

- Email notifications: Test the website's email notification system to ensure that it distributes policy updates, payment reminders, and other critical events to users in a timely and correct manner.

- Social media integration: Examine the website's integration with social media platforms like Facebook and Twitter to ensure that users can readily share or promote policy-related content.

- Search functionality: While performing insurance domain testing, test the website's search capability to ensure that users can locate the information they need, such as policy details, support articles, or contact information, quickly and accurately.

- Mobile app testing: Test the website's mobile app version to ensure that it provides a smooth and consistent user experience across multiple platforms, such as iOS and Android.

- Performance on low-ending devices: Evaluate the website's performance on low-end devices, such as inexpensive smartphones or ancient laptops, to ensure that it stays functional and responsive.

- Affiliate marketing tracking: If your website has an affiliate marketing tracking system, be sure it appropriately tracks referral traffic and conversions.

- Cross-browser compatibility: it is another important test case in insurance domain testing. It includes examining the website's compatibility across different browser versions and platforms to confirm that it displays and performs correctly in each browser.

- Handling dynamic content: Check the website's ability to handle dynamic content, such as videos, animations, or real-time data, and make that it loads swiftly and without errors.

- Backup and recovery testing: Verify that the website's backup and recovery system can restore user data and website functioning in the event of a disaster or data loss.

- Geolocation functionality: If the website has one, test it to ensure that it accurately identifies the user's location and provides relevant information and services. Also, check that the price and insurance options on the website are based on correct geolocation data and that users are presented with policies and pricing that are relevant to their area and region.

- Cookie management: Test the website's cookie management system to ensure that cookies are used appropriately and securely and that users have clear information and choices regarding cookies.

- Error handling: Test the website's error handling system to ensure that when errors occur, users receive clear and useful error messages and that errors are adequately logged for analysis.

- Data encryption: Verify that the website's data encryption system encrypts sensitive user data, such as passwords and payment information, using robust and up-to-date encryption techniques.

- Disaster recovery testing: In the event of a disaster or data loss, test the website's disaster recovery plan to confirm that it can swiftly and successfully restore the website's functionality and user data.

- Session management: During insurance application testing, test the website's session management system to confirm that it handles user sessions securely, including session timeouts, session hijacking prevention, and session invalidation.

- Content management: During insurance application testing, check the website's content management system to make that it has a user-friendly interface for managing website material such as policy details, support articles, or blog posts.

- Social proof elements: Verify that the website's social proof elements, such as user testimonials, reviews, or ratings, are factual and relevant, as well as that they adhere to ethical norms and guidelines.

- SSL/TLS testing: Examine the website's SSL/TLS implementation to check that it employs robust and up-to-date encryption techniques and that SSL/TLS certificates are properly validated.

- SEO optimization: Evaluate the website's search engine optimization (SEO) performance and ensure that best practices for on-page optimization, such as metadata, headings, and keywords, are followed, as well as that it complies with search engine guidelines and algorithms.

- Marketing and promotions: Check to see if the website's marketing and promotions are effective and appealing to users, with clear and compelling language, engaging content, and compelling calls to action.

- User data privacy: Confirm that the website complies with user data privacy requirements, such as the GDPR or the CCPA, and that it secures user data through appropriate security measures, such as encryption and access controls.

- Regulatory compliance: Examine to see if the website complies with relevant insurance regulations and requirements, such as state or federal insurance legislation, and that policies and claims processing is in accordance with these restrictions.

- Integration with insurance providers: Test to see if the website connects successfully with insurance providers, provides clear and accurate policy information, and has a quick policy application and claims processing process.

- Integration with healthcare providers: Verify to see if the website interfaces successfully with healthcare providers, providing clear and accurate medical information and claims processing, as well as appropriate data sharing and privacy restrictions.

- Test data management: Ensure that the website's test data management is effective, including adequate data masking and anonymization, and that test data is not used for non-testing reasons.

- DevOps testing: Ensure that the website's DevOps pipeline is efficient and effective, with automated testing and deployment processes, and that code changes are reviewed and tested thoroughly before deployment.

- Third-party risk management: Confirm that the website has adequate risk management processes in place for third-party systems and services such as insurance providers and payment gateways, including risk assessments, audits, and monitoring.

Download test case templates for insurance domain testing now!

Download the Insurance domain testing test case template to efficiently evaluate and ensure the quality of your insurance domain websites.

SEE MORE →Perform insurance domain testing with LambdaTest

You already realized that managing tests for insurance domain websites requires a lot of effort. However, LambdaTest’s digital experience cloud can leverage your release speed and will help you to give your customers a seamless digital experience. With LambdaTest you can:

- Debug your insurance domain websites with the help of various logs such as command logs, network logs, and video recordings.

- Executing your Insurance domain testing 70% faster with HyperExecute, the fastest end-to-end test orchestration cloud from LambdaTest.

- Easily integrate with your CI/CD pipelines.

- Apart from the Insurance domain, LambdaTest supports all major domains such as retail, finance, healthcare, and many more.

Wrapping it up!

Insurance domain testing is an important component of ensuring that insurance software systems are dependable, secure and meet the needs of consumers and stakeholders. With the insurance industry's continuing change, testing will become increasingly vital to ensure that new technology and procedures are effectively integrated into old systems. As a result, it is critical to prioritize insurance domain testing and invest in the necessary tools, skills, and test cases you read assure its success.

Frequently Asked Questions (FAQs)

What is meant by the insurance domain?

It covers disability as well as accidental death and dismemberment. It is also a contract between an insurer and an insured person, i.e. an individual, and this contract is renewable according to an insurance company's laws and regulations.

What are the different types of testing domains?

Among the projects in which domain expertise is essential are: 1. Banking and finance 2. Healthcare Software Domain. 3. e-Commerce Domain. 4. ERP Domain. 5. Mobile Application Testing Domain. 6. Insurance Sector Domain. 7. Retail, Travel & Hospitality sector.

What is domain testing with an example?

Domain testing is an essential software testing technique in which a domain is divided into subdomains and then tested using values from each subdomain. For example, if a website has been assigned for testing, we will divide it into separate sections (subdomains) to facilitate testing.

Start your journey with LambdaTest

Get 100 minutes of automation test minutes FREE!!

Did you find this page helpful?